It was once said that cash is king, but in this digital age, having physical notes to pay for things seems like a thing of the past. How often have you been in a group setting and heard someone exclaim something along the lines of, “I don’t have cash on me,” or, “Can I pay with my card?”

Digital payments are fast and easy to do, making them far more efficient than cash, where you more often than not hold up the line looking for the exact change. Also, with physical notes having exchanged hands countless times, going digital is far more alluring in this post-pandemic era we’re now in.

Now, it’s likely that the e-wallets you’ve heard of in Malaysia are GrabPay, Boost, and Touch n Go. But do you know that there are others too? Let’s look further into these user-friendly e-wallet apps that are perfect to have on your phone — even for your travels.

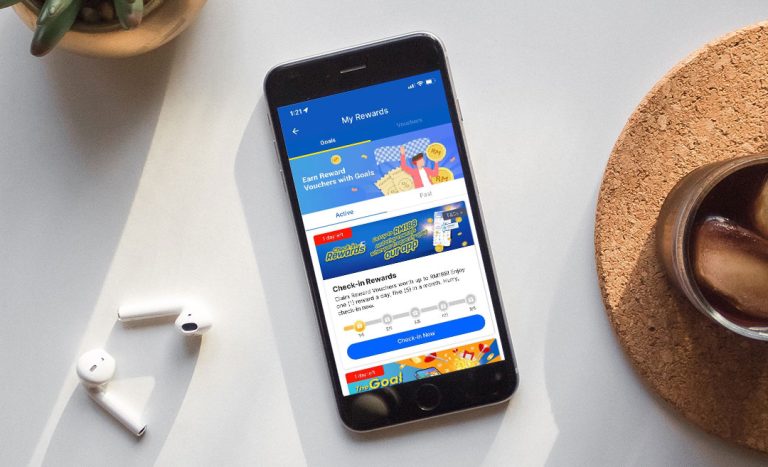

GrabPay

Let’s kick off our list with GrabPay – arguably the most widely used in Malaysia. What started as a ride-sharing app has now turned into an app that Malaysians use for almost everything. Be it for e-hailing services, groceries, food, and other necessities.

GrabPay has grown from an e-wallet platform to an e-wallet card that partners with MasterCard and allows for a real-time conversion rate. While this product is currently only in Singapore, it will arrive on Malaysia’s shores soon.

GrabPay also has a ‘buy now, pay later’ feature, which is essentially an instalment plan that makes shopping that much easier. Users can pay at the end of the month through their GrabPay e-wallet. Grab also has cross-border gifting options for Singapore, the Philippines, Thailand, and Myanmar.

So, if you’re planning to travel around Southeast Asia anytime soon, have this app installed on your phone if you haven’t already.

Boost

A fintech arm of Axiata, you’ve probably seen the skewed heart-shaped symbol resembling the letter ‘B’. With its presence growing stronger every day, Boost has more than a few hundred thousand touch-points. This e-wallet service also provides cash back rewards to its users depending on the amount used per transaction.

Besides being an e-wallet platform, Boost provides other financial services like bill payments, buying groceries, food delivery, and even insurance! Through their partnership with UnionPay, Boost users can make cross-border payments seamlessly in over 100 countries worldwide.

Touch ‘n Go

More than just a ‘beep, beep’ card that you use at the toll, which can only be topped up at selected kiosks and petrol stations, the Touch ’n Go app is pretty handy. Since its expansion, the app offers parking payment services, toll payment, prepaid services, and you can even obtain your CTOS score (your credit rating for those not in the know) from this app.

From everyday functions that help make life easier to transportation services and financial ones, like Gopinjam, which allows you to apply for a quick loan of up to RM10,000 in three simple steps, this app is definitely helpful to have on your phone.

You can even pay your utility bills and book a holiday on this app. Do you need a lightbulb to be replaced? You can even shop at MR.DIY on the Touch ’n Go app. We weren’t kidding when we said this app had it all.

BigPay

BigPay by AirAsia is probably the most travel-friendly e-wallet in Malaysia as they have an application you can easily download and physical debit cards for payments. Partnered with MasterCard and Visa, the card allows you to withdraw cash using the BigPay card at an ATM with a maximum of RM10,000 daily.

Their e-wallet is accepted at over 40 million merchants worldwide with real-time exchange rates and no mark-up fees. Not a bad thing to have! You can also transfer the funds to other banks in Australia, Bangladesh, China, India, Indonesia, Nepal, Singapore, Thailand, Philippines, and Vietnam at the cheapest cost compared to the banks’ rate!

BigPay also links to AirAsia Big Loyalty points for you to redeem in the future. So, for those who have plans for overseas travel, try this cashless option. Splitting the bill with your friends on BigPay is so easy too!

CurrencyFair

Look, you just never know when you’ll need to wire some money when you’re travelling, and if that time comes, it’ll be wise to have an app like this one. Rated 4.6 out of 5 stars by Trustpilot, CurrencyFair makes it easy to send money overseas, and with better exchange rates too. We’re talking eight times cheaper than the banks!

With this app, you can send and receive money securely to and from over 150 countries, and should you have any user issues, their excellent customer service will give you the kind of real-time support you need.

Their key features include multi-currency accounts, rate alerts, and a ‘refer a friend’ reward, amongst a few. You can also manage your purchase of overseas property, your international bills, and pay overseas tax too!

Wise

If you’re a seasoned traveller, then you’re probably already familiar with Wise. Besides using real-time exchange rates, this app also charges a pretty competitive fee compared to major banks in Malaysia.

With Wise, you can receive your money from the UK, US, New Zealand, Australia, and many other European countries. What’s even better about Wise? It converts any foreign currency into a local currency of your chosen residential country without any annual fees.

There’s also the option of having a Wise card, which works like a debit card and is pretty straightforward. You can use it everywhere (we’re talking 200 countries) and easily withdraw cash from over 2 million ATMs.

Does it get any better? You bet it does! Wise can also link up with your Amazon and PayPal, allowing users a seamless shopping experience and promoting remote work. Much like CurrencyFair, users of this platform can also pay their international bills and manage the finances of international properties, should they need to.

Overall, this app will help you spend money overseas or in your home country wisely (see what we did there?) without any hidden charges!